Will AI Replace Accountants? A Complete Guide

Table of Contents

AI is transforming industries worldwide, and accounting is no exception. With the rise of technologies like machine learning and robotic process automation (RPA), the question, “Will AI replace accountants?” has become more pressing.

While AI can automate many tasks, the straightforward answer is that AI will not fully replace accountants. Instead, it will be a powerful tool that helps accounting professionals do their jobs better. In this article, we will explore how AI is reshaping accounting, its current and future capabilities, and why human accountants will remain essential despite these technological advancements.

How AI Is Changing Accounting

The advent of AI in accounting is transforming the profession in ways that were once considered unimaginable. While AI can’t replace the critical thinking and judgment of accountants, it is simplifying many routine and time-consuming tasks.

Technologies like machine learning and robotic process automation (RPA) are now used to handle repetitive tasks such as data entry, transaction processing, and reconciliation. These tasks, once requiring significant human involvement, are now automated, freeing up accountants to engage in more complex decision-making and advisory roles. By reducing manual work, AI boosts efficiency, reduces errors, and allows accountants to offer deeper insights into financial data.

However, rather than replacing accountants, AI is reshaping their roles, empowering them to focus on higher-level functions that require human expertise and judgment. This shift highlights AI’s potential to complement, not replace, human professionals in accounting.

Accounting Tasks AI Can Automate

AI is making a tremendous impact by automating several key accounting tasks. These advancements are not about replacing accountants, but rather enabling them to focus on tasks that require human expertise.

Key tasks that AI can accelerate include:

- Data Entry: By automating data entry, AI reduces errors and accelerates the process, giving accountants more time to focus on strategic tasks such as analysis and reporting.

- Tax Filing: AI can assist in preparing and filing taxes by analyzing financial data and applying the latest tax regulations. This ensures both accuracy and efficiency in tax compliance, minimizing errors that could lead to costly fines.

- Audit Tasks: AI tools analyze financial data for discrepancies and ensure that audits are thorough, compliant, and free from oversight. This improves the detection of fraud or inconsistencies that might otherwise be missed.

- Financial Reporting: AI’s ability to automate the generation of financial reports streamlines the reporting process, ensuring timely and accurate financial information with minimal manual effort.

- Predictive Analytics: AI can analyze historical trends to forecast future financial patterns. This capability is especially valuable in budgeting, investment planning, and identifying future growth opportunities.

To provide a clearer understanding of AI’s impact on accounting tasks, here’s a table illustrating key AI tools and functions:

| AI Tool | Automated Task | Impact on Accountants |

|---|---|---|

| Machine Learning | Financial Analysis | Faster and more accurate insights |

| Robotic Process Automation | Data Entry, Tax Filing | Reduced errors, time savings |

| Predictive Analytics | Forecasting, Investment Planning | More accurate decision-making |

| AI-Driven Audit Tools | Auditing and Compliance Checks | Improved accuracy and fraud detection |

These AI tools allow accountants to spend more time on tasks that require deep financial insight, rather than getting bogged down in routine processes.

AI’s Limitations on Accountants

Although AI has revolutionized many aspects of accounting, there are several limitations that prevent it from fully replacing human accountants.

- Lack of Human Insight: AI is powerful at processing data, but it cannot replicate the human ability to make judgment calls or navigate complex, uncertain situations. Accountants often rely on their professional experience to make decisions in areas where data alone is insufficient.

- Data Reliability: AI operates based on the quality of the data it is fed. If the data is incomplete or inaccurate, AI’s conclusions may be misleading, leading to financial misstatements.

- Ethical Considerations: Accountants often face ethical dilemmas, such as conflicts of interest or navigating ambiguous situations. AI lacks the capacity to make ethical judgments, making human involvement essential in these circumstances. Read more about AI’s limitations in professional environments.

- Client Relationships: While AI can provide data, it cannot build the personal relationships that accountants cultivate with clients. Trust and personalized advice are key components of the profession that AI cannot replicate.

- Accountability: Accountants are responsible for financial decisions, and in the event of errors, they are held accountable. AI, while helpful, can make mistakes that lead to legal or financial ramifications, ultimately requiring human oversight.

How AI Will Change Accountants in the Future

As AI continues to advance, it will significantly transform the role of accountants, shifting their responsibilities to more strategic and advisory functions. In the future, AI will serve as a partner, assisting accountants in delivering more accurate and timely insights.

- Strategic Advisory: With routine tasks automated, accountants will move into roles that require strategic thinking. They will provide insights based on data analysis, helping businesses make informed decisions that drive growth.

- Improved Decision-Making: AI’s ability to process and analyze data will allow accountants to offer more accurate financial forecasts and improve decision-making processes. Businesses will rely on accountants to interpret AI-driven insights and guide them through complex financial decisions.

- Enhanced Client Interactions: AI will enable real-time monitoring of financial data, allowing accountants to offer proactive advice rather than reactive solutions. This shift positions accountants as key partners in helping clients navigate financial challenges.

- New Skills and Roles: As AI tools become more integrated into accounting practices, accountants will need to develop proficiency in using these tools. Skills in data analytics, AI applications, and technology integration will become essential for staying competitive in the evolving profession.

- Human-AI Collaboration: The future of accounting lies in collaboration between human professionals and AI systems. While AI will handle data-intensive tasks, accountants will focus on areas requiring human expertise, such as interpreting data and building relationships.

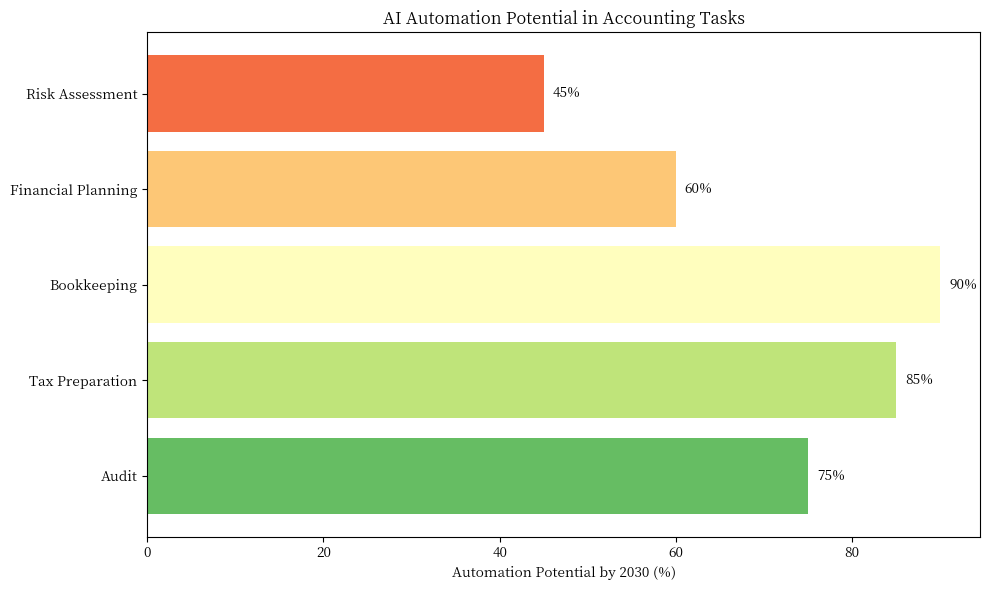

This image shows the transformation of the accounting profession by AI through three charts, illustrating the shift in time allocation, evolution of required skills, and automation potential of various accounting tasks from the present to 2030.

According to industry leaders, the role of accountants will become increasingly important in guiding AI-driven decision-making and ensuring compliance with regulations. Firms that embrace AI will offer their clients more personalized services, improving overall business outcomes.

Bonus Tips: How AI Can Help You Find a Job

Jobright is an innovative AI-powered job search platform designed to speed up your job search. With access to over 8 million job listings, it offers personalized job matching, resume optimization, and networking opportunities. Jobright also provides 24/7 AI support, helping you secure interviews and job offers faster and more efficiently. Whether you’re frustrated with traditional methods or seeking better job matches, Jobright’s advanced features empower you to take control of your job search and land your ideal position.

Struggling to Craft Your Story?

Get Personal Cover Letter Tips on Jobright.ai

Leverage Our AI Co-pilot Orion and receive personalized cover letter inspiration for every position

Try Orion for FREEConclusion

As AI continues to evolve, accountants will increasingly focus on strategic decision-making, advisory roles, and client relationships—areas where human expertise is essential. By automating routine tasks, AI will free up accountants to offer more valuable financial insights.

In conclusion, AI won’t replace accountants, but it will enhance their work. The future of accounting lies in a partnership between AI and human professionals, ensuring that accountants continue to play a key role in navigating complex financial decisions.